29 Dec 2017

With the New Year bells ringing, good news is underway for India as its economy is poised to win back its tag of the fastest growing economy in the world. The recent upgrade of India’s rating by the US based credit rating agency Moody’s (Baa2 from Baa3) in recognition of the reforms agenda pursued by the Government is a major boost to investor confidence. Further, as the short term disruptions caused by major reforms such as the Goods and Services Tax (GST) and demonetization recede, the economy is on the rebound and is likely to achieve higher growth targets in the New Year.

GDP Growth

Gross Domestic Product (GDP) is on a recovery path after slowdown in the first quarter of 2017-18, and real GDP growth for the second quarter (2QFY18) increased to 6.3% from 5.7% in the previous quarter, a likely fallout of the introduction of GST. The second half of 2017-18 will witness a higher growth rate, and this is further expected to consolidate in the coming New Year, as the benefits of GST and other reforms gain traction.

Sectoral Growth

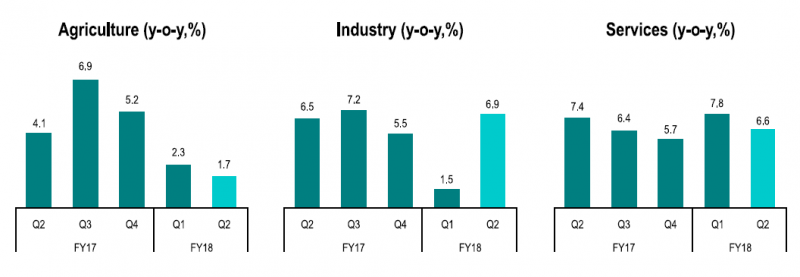

The agricultural sector registered moderate growth as erratic monsoon in several parts and flooding in some states impacted performance.

Industrial growth accelerated sharply during the second quarter of FY 2018 and jumped to 6.9% from 1.5% in the previous quarter, on account of a sharp increase in manufacturing and electricity, gas, water supply and utility services. Manufacturing registered an impressive growth at 7% in 2QFY18 as compared to 1.2% posted in the first quarter.

Services sector grew only marginally at 6.6% in the second quarter as compared to 7.8% in the previous quarter.

Inflation

The economy saw high inflation during October 2017 owing to elevated food prices. Going forward, this is likely to be contained on account of a good harvest and favourable monsoons.

The impact of GST on prices is likely to become clearer in the coming year as the teething problems related to its implementation ease out. Further, the GST Council’s decision to cut tax rates on 177 items is also expected to partially ease the inflationary pressure, as the companies start passing the benefits of lower prices to consumers.

External Sector

Healthy foreign fund inflows caused the rupee to strengthen during the latter half of the year. The recent Moody’s upgrade is likely to encourage further inflows and the rupee could appreciate further. On the other hand, the impact of the decision in the US to raise interest rates and introduce tax cuts may work the other way. In any case, India’s consumer markets are expected to remain a strong incentive to FDI.

A contraction in export growth pushed the merchandise trade deficit to a near 3-year high in October 2017, which was forcefully reversed in November with a positive growth rate of over 30%. With the streamlining of GST related issues and some changes in GST rules by the Government as well as firming of global recovery, export growth will emerge as a powerful growth driver in 2018.

Monetary Policy

The Reserve Bank of India (RBI) kept policy rates unchanged in its fifth bi-monthly monetary policy meeting on 6th December, 2017. However, industry is hopeful that going forward, RBI would lower interest rates to boost broad-based investment and consumption activity which in turn would promote economic growth.

Credit Growth

Credit growth to the non-food sector shows encouraging signs of pick-up in the last few months. Recapitalization of Public Sector Banks may bolster credit flows further and ease their stressed assets situation.

CII Business Confidence Index

The Business Confidence Index (BCI) by Confederation of Indian Industry (CII), climbed up to 59.7 during October-December 2017 as against 58.3 in the previous quarter. This increase was a result of improvement in the perception regarding overall economic conditions and expectations of improved business situation post the recent disruptions which prompted companies to be optimistic about favourable economic growth in the future. The findings are part of CII’s 101st edition of quarterly Business Outlook Survey, based on around 200 responses from large, medium, small and micro firms, covering all regions of the country.

The recovery recorded in the index coupled with India’s sharp improvement in the Ease of Doing Business rankings (India jumped 30 places to 100) this year reinforces company perception that demand pick up is underway. Most of the respondents in the survey also believe that GST payments would become hassle-free by Q1 2018-19.

Challenges

Firms rated low domestic demand followed by high commodity prices as main concerns in CII’s Business Outlook Survey. Stepping up private investment remains a major macroeconomic challenge in the next year.

Inflationary pressures also remain a concern. Though food prices are likely to be contained on account of favourable monsoons, caution must be exercised as upside risks still remain in the form of implementation of farm loan waiver and 7th Pay Commission hand-outs.

India’s share in world exports is currently at 1.8%. Efforts to increase this figure by way of providing export credit to manufacturers, increasing the capital base of Export Credit Guarantee Scheme (ECGC), increasing subvention to 4% etc. must be undertaken.

The economy benefitted from increased foreign inflows during the latter half of 2017. While this is good news, efforts to contain further appreciation of the rupee should be in place as further strengthening may affect exports and job creation.

Bank credit growth hit a 20 year low in 2016-17 with Non-Performing Assets (NPAs) at 9.9%. India has been ranked fifth on the list of countries with highest NPAs. Though bank recapitalization efforts are underway, the economy needs to recover from the bad loan problem quickly for favourable economic growth in the future.

The infrastructure deficit is a major concern and infrastructure investment needs to be stepped up as currently it is not in par with the needs of the economy.

Other challenges for the economy include addressing infrastructural bottlenecks in the agricultural sector, investment in human resources to leverage the demographic dividend, increasing expenditure on education and healthcare sectors, and social security provision for the unorganized sector.

With on-going reforms that are beginning to positively impact the economy, CII is optimistic about Indian growth prospects in 2018. At the same time, policymakers need to be watchful and address the current macroeconomic challenges for a sustainable and fruitful recovery.

Source: CII Economy Matters (Nov Issue)